A few weeks ago, a patient gleefully told me that he had gotten excellent new health insurance through his employer. The coverage included more chiropractic visits than his previous insurance plan, yet his co-pay was still minimal.

It was difficult for me to share his excitement—especially since I knew what he would tell me next.

“It’s a chiropractic HMO,” he said. “And it gives me 20 visits per year with only a $15 co-pay.”

“That’s great,” I replied. For my patient…maybe.

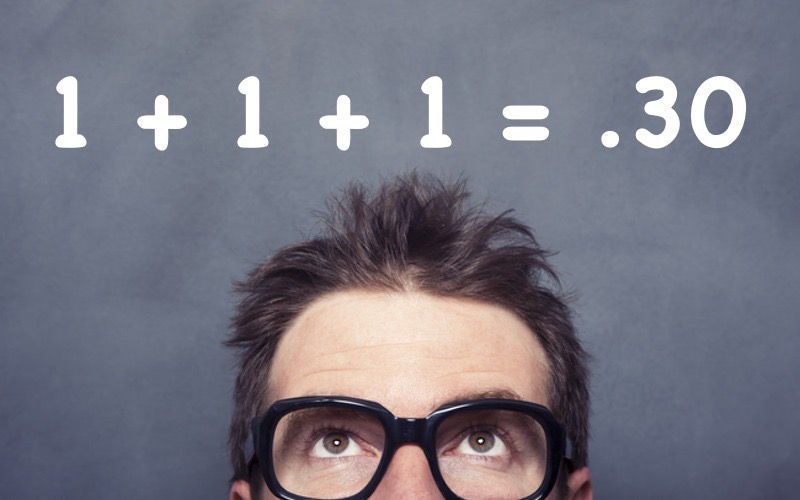

Here’s the backstory. My patient’s previous policy was a standard Blue Cross PPO (Preferred Provider Organization). The policy allowed 12 chiropractic treatments per year and reimbursed me, the provider, approximately $75 per treatment. After I submitted my bill, Blue Cross sent me a check for $60 ($75 less the $15 co-pay).

His new plan, on the other hand, is a chiropractic HMO (Health Maintenance Organization). Their policy allows 20 visits each year, but reimburses me at less than $30 per visit. The co-pay, again, is about $15. My patients “excellent” new health insurer will send me a check for less than $15.

The conclusion: I’d just received a 60% pay cut. I don’t think my patient realized that.

My Personal Relationship With Health Insurance

I have been in practice since 1986. At that time, most insurance plans covered chiropractic services and reimbursement was fair.

In the late 1980s and early 1990s, we saw a surge in the growth of managed care programs. Attempting to control costs, the insurance industry built large networks of “preferred provider organizations” (PPOs), which agreed to accept industry-determined fee schedules. In exchange for being “in network,” the providers gained access to the many patient/members of those plans. Providers who chose to remain independent were able to collect higher fees, but they faced obstacles. For example, patients seeking out-of-network care might face large deductibles and co-pays. Using this strategy, insurance companies were able to steer most patients toward in-network doctors.

Insurance companies quickly realized that PPOs were a profitable path. Controlling costs in this way enabled them to keep disbursements down, continue to raise premiums, and keep profits strong and steady.

After the successful entrenchment of the PPO, the insurance industry sought to develop newer, even more “efficient” systems of health care delivery. Enter the HMO.

The HMO (Health Maintenance Organization), like the PPO, was not a new concept. Kaiser Permanente, the country’s largest HMO, was established in California during World War II to provide health care for shipyard workers. It then expanded to serve the general public. Kaiser medical centers are now freestanding hospitals and clinics serving Kaiser members exclusively.

Other insurance companies then sought to establish their own HMOs without the burden of building hospital complexes. Well-known examples include HealthNet, Pacificare, and Humana. Though established in the 1970s and 1980s, these companies rapidly expanded their share of this market from the 1990s onward in response to the changing health care climate. They connected existing hospitals and medical practices to create their own dedicated networks. Members could only see in-network providers. Because they now had nearly monopolistic control over patient choice, insurance companies were able to negotiate even lower fees with the providers–who would theoretically be grateful for having access to this “captive market.” The insurers could then pass along these savings in the form of lower premiums, zero deductibles, and smaller co-pays.

During this period, there also grew an increased public awareness of—and demand for–complementary and alternative treatments, like chiropractic, acupuncture, and massage therapy. In response, Chiropractic HMO’s first began to appear in 1987. (It later added the other complementary/alternative modalities.) When companies purchased their policies from brokers, they would often buy a standard medical HMO plan along with a chiropractic supplement to provide workers with these complementary services. My patients particular HMO now dominates this part of the health care market.

I have been a participating member of his plan since 2001. At that time the re-imbursement per doctor visit was in the high thirty dollar range. There was an additional bonus at the end of the year based upon ones efficiency or productivity (Read: limiting treatment and minimizing referrals.) This was called a “withhold fee.”

By 2004 the reimbursement had dropped to under $30 and the yearly withhold was eliminated. It has not changed since.

The Numbers

As a chiropractor I see between three and four patients per hour. When reimbursed at a rate of approximately $75 per visit, I generate between $250 and $300 per hour. I run a very efficient, well staffed, and pleasant office on a great street in San Francisco. (I think my patients would agree with my assessment). I provide high quality care. I pay my staff a fair wage for their work. The overhead of my office runs at approximately 50%. So when I am working at maximum efficiency, my income is between $125 and $150 per hour (This does not include the hours of paperwork and administration that I must do, which is unbilled labor.)

If all of my patients used this insurance plan my earnings would be somewhere around $85 to $120 per hour on average. This is less than the cost of running my office.

The Future

The major insurance companies–Blue Cross/Blue Shield, Cigna, Aetna—are aware that these chiropractic HMOs are building network of providers who will accept radically reduced rates. So they, too, have begun contracting with these plans to administer their chiropractic benefit as part of their PPO and HMO plans.

The result is that increasing numbers of patients with chiropractic, acupuncture, and massage coverage will be receiving it through these highly restrictive plans. And providers will be denied a livable reimbursement for their work. Eventually, complementary/alternative practitioners will be forced out of the insurance reimbursement system altogether.

Health insurance policies will soon be divided into three basic types: (1) HMOs that restrict choice of doctors and access to complementary therapies; (2) super high ($3,000-$5,000) deductible plans that will discourage many sick people from seeking care until they are in emergency situations, and (3) high end “Cadillac PPO” plans that allow freedom of choice of providers with minimal restrictions. These Cadillac policies will comprise only 1-2% of all plans.

I have had a full career in the healing arts. I have been able to practice my craft, to help patients in need, and participate in what I once believed to be a health care system evolving toward a model rooted in wellness and prevention. But I now see that this belief was an illusion. I realize that health care is just another rough and tumble, profit driven business. The players with the most money—the pharmaceutical, insurance, and hospital industries—are the ones who win the game.

As this process lumbers on, insurance companies will continue raising premiums beyond the inflation rate, covered services will be increasingly limited, providers will have fees reduced further, deductibles will continue to rise, and insurance company profits will continue to grow. Until they don’t.

Epilogue

Healing is both a science and an art. It requires careful listening so that one can determine a proper diagnosis and outline an appropriate course of treatment. And it requires time to “be” with ones patient. To support my clinic with HMO reimbursements alone, I would need to see 10-12 patients per hour.

I cannot, will not do that. I will continue to do my work, to treat causes rather than symptoms, to educate my patients about their own bodies, to empower them to heal themselves. But not within a system that does not honor these values. I reject the reimbursement schemes that will ultimately undermine my profession and others that are truly rooted in prevention.

If this means closing my practice, and working on my own, to provide the quality, affordable care I was trained to give–the care that provides value and meaning to both my patients and myself, so be it. I will leave the system before it abandons me and the patients it has a mandate to serve.

The Affordable Care Act, or Obamacare, will do little to change the direction our system is heading. Certainly more of the uninsured population will be saved from life threatening situations, which is a very good thing. But the delivery of services will still be under the control of the same interests that have long been in control. And while there will be a superficial nod to the concept of “wellness,” the delivery of these services will be administered by a medical industry deeply rooted in reactive treatments—primarily the use of drugs and surgery. Practitioners of complementary and alternative methods of healing will be excluded.

America’s health insurance system is not on a sustainable course. In my view, it is on the verge of collapse.

And when it does collapse–when insurance policies cost more than most Americans can afford (we are just about there!)–when businesses choose to pay penalties rather than to insure their workers, and individuals do the same, the stark illogic of this system will reveal itself, and the impetus for real and radical change will emerge.

It may not occur overnight–but this change will surely come.

Stay tuned for Part Two of this series.

Dr. Ricky Fishman has been a San Francisco based Chiropractor since 1986. In addition to treating patients with musculoskeletal complaints, he has been actively involved with a variety of wellness companies working toward the transformation of health care delivery for the 21st century.

Copyright Ricky Fishman 2013

[email protected] www.rickyfishman.com

Sad but unfortunately so true. Caregivers like Ricky must be supported for the sake of everyone”s overall health and well-being. I see what Ricky writes about daily in my law practice.

As an Acupuncturist, I’d like to add Insurance Companies, set up numerous hurdles to block the provider from getting paid at all. This includes web sites that bump you off while you are filling out their endless and onerous forms, multiple, somewhat secret adresses for billing, “lost” bills and invoice rejections over the most minor clerical errors. I quit my association with these companies years ago, and I left thousands of dollars uncollected because it was just too difficult to do so.

I was once the the clinical director of a large acupuncture clinic and we had a book keeper who was a former insurance company employee. She told me that it was the insurance companies policy to throw every tenth bill into the shredder so that the provider would have to re-bill or just give up on getting reimbursed. ASHP and other carriers like them, have nothing to do with health care. It’s all about the bottom line.

FABULOUS Article. I have believed for a long time that patients have no clue about how the insurance industry has pitted their pocketbook against the providers’. Just as your patient believed something good had happened with his insurance.

I am going to send your article to everyone I know. It is written with clarity, depth and understanding. Thank you for your time and effort!

Dr. Fishman provides a timely and cogent analysis. Independent complimentary providers of wellness therapies are being squeezed while profits are protected for the conventional medical industry. So – called alternative and adjunctive therapies, that are widely recommended and proven effective, are increasingly being denied reasonable reimbursement. Only those individuals and families who are well heeled could participate in a cash based system that would support independent wellness providers.

To Robert: Thanks for your comment. In fairness to some parts of the “medical industry” I have to say that the insurance company strategy is not restricted to complementary and alternative providers. Medical doctors, especially general practitioners, are being squeezed as well. They are being forced to see more and more patients per hour just as we are and having to do all the additional paperwork that comes with the increased volume. Part of the problem is that the general public has the perception that all doctors are rich and so they don’t care about having them take cuts. This is one of the reasons I wrote this piece: to pull the covers on this false belief.

Ricky describes the current situation with accuracy and an unusual amount of frankness. Like many many professional care-providers, he just wants to help people while making a decent living. It’s true that there’s nothing in the nearterm coming out of Washington that addresses the underlying issues Ricky lays out. We are in the midst of a transition across the economy where the value of a day’s work is marginalized in favor of low- (or no-) taxed profits going to investors. Healthcare is just the latest (if not also perhaps among the most important) of the casualties. My only advice: stay healthy.

well done Ricky. You have done a wonderful job outlining the challenges and problems in our current health care system. It is terrible that the insurance company is failing and fooling both you and your client. I am disappointed that Obama Care won’t address these inadequacies and holes in the health care system. Thank you for enlightening us with your words and wisdom and please keep practicing.

It’s nearly impossible to find well-informed people in this particular subject, but you sound like you know what you’re talking about!

Thanks

I wanted to thank you for this very good read!! I absolutely enjoyed every bit of it.

I’ve got you saved as a favorite to look at new stuff you post…

i agree. you know what needs to be done? get a movement going online and elsewhere where you get all or most of the chiropractors and other doctors if they want and like a MILLION or more people with health insurance to sign a petition that says on a certain day, they’re ALL going to dump their insurance companies until reimbursement and covered services start INCREASING for chiropractors and doctors not DECREASING like they have been and co-pays and deductibles start DECREASING for the consumers. that’s the only way the chiropractors and people with health insurance can take on these big corrupt companies…..HIT EM IN THEIR WALLETS like they’ve been doing to us. hopefully the news will pick it up and more and more people will do it until we can bring some fairness and power back to the doctors and people and hold these greedy corrupt insurance companies and politicians accountable. wouldn’t that be a great feeling as a group of people to be able to let these companies know that no matter how big and powerful you get, there is a point at which people will stand up together and put an end to your greed?